CEO ECONOMIC OUTLOOK INDEX

Business Roundtable Q4 Economic Index Shifts Higher on CEO Expectations and Plans for 2025

Washington – Business Roundtable today released its Q4 2024 CEO Economic Outlook Survey, a composite index of CEO plans for capital spending and employment and expectations for sales over the next six months.

The overall Index rose 12 points from last quarter to 91, the highest level in over two years and well above its historic average of 83. The increase is the result of CEOs reporting higher numbers across all three subindices.

“As we head into the new year, the Survey results reflect CEOs’ optimism about the U.S. economy in the coming months,” said Business Roundtable Chair Chuck Robbins, Chair and Chief Executive Officer of Cisco. “With Washington poised to consider measures that can protect and strengthen tax reform, enable a sensible regulatory environment, and drive investment and job creation, business leaders are energized by the opportunity to engage the incoming Administration and Congress on policies that can further fuel our economy.”

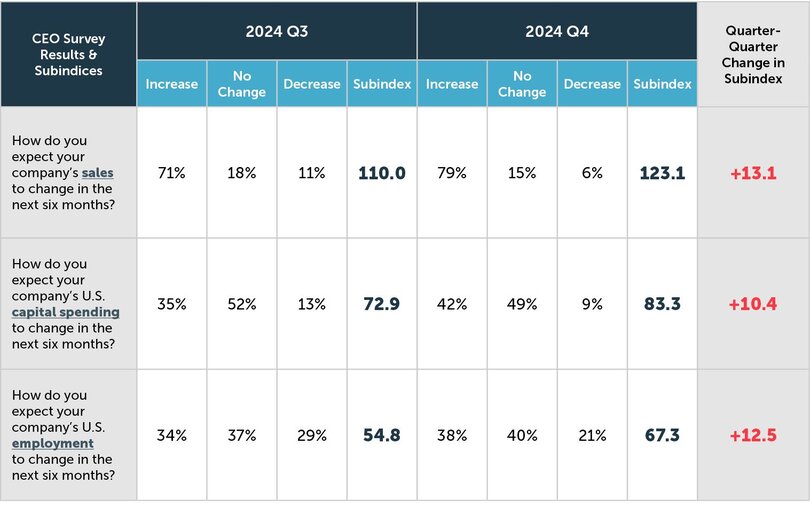

The Survey’s three subindices were as follows:

- Plans for hiring increased 12 points to a value of 67.

- Plans for capital investment increased 10 points to a value of 83.

- Expectations for sales increased 13 points to a value of 123.

“The CEO Economic Outlook Index is well above its long-run average for the first time in nine quarters,” said Business Roundtable CEO Joshua Bolten. “Building on this, Business Roundtable’s top priority is maintaining and strengthening the competitiveness of the American economy. That means working with policymakers to support pro-growth provisions of the Tax Cuts and Jobs Act; scale back burdensome regulations; and expand high-standard trade agreements, while avoiding overly-broad tariffs that could stoke inflation and raise costs for American businesses and consumers.”

In their first estimate of 2025 U.S. GDP growth, CEOs projected 2.6% growth for the year.

In a question posed every fourth quarter since 2003, CEOs were asked to identify the greatest cost pressure facing their company. Forty-seven percent of CEOs identified labor costs as the top cost pressure for the eighth consecutive year. Twenty percent of respondents selected regulatory costs as their top cost pressure, and 15% identified material costs.

This quarter’s survey was in the field from November 20 through December 5, 2024. In total, 156 CEOs completed the survey.

About the Business Roundtable CEO Economic Outlook Survey

The Business Roundtable CEO Economic Outlook Survey, conducted quarterly since the fourth quarter of 2002, provides a forward-looking view of the economy by Business Roundtable member CEOs. The survey is designed to provide a picture of the future direction of the U.S. economy by asking CEOs to report their company’s expectations for sales and plans for capital spending and hiring over the next six months. The data are used to create the Business Roundtable CEO Economic Outlook Index and sub-indices for sales, capex and hiring. These indices are diffusion indices that range between -50 and 150 — where readings at 50 or above indicate economic expansion, and readings below 50 indicate economic contraction. A diffusion index is defined as the percentage of respondents who report that a measure will increase, minus the percentage who report that the measure will decrease. The diffusion indices here are then normalized by adding 50 to the result.