CEO ECONOMIC OUTLOOK INDEX

Business Roundtable CEO Economic Outlook Index Posts Slight Gain, Still Lagging Historically

Washington – Business Roundtable today released its Q3 2025 CEO Economic Outlook Survey, a composite index of CEO plans for capital spending and employment and expectations for sales over the next six months.

The overall Index edged up slightly by seven points from last quarter to 76, still below its historic average of 83. The modest gain reflects an uptick in CEO plans for capital investment and a marginal increase in their expectations for sales. Additionally, hiring plans remain largely unchanged from last quarter, inching up a couple of points and consistent with a softening labor market.

“The increase in capex plans signals CEOs are optimistic about the pro-growth tax policies in the recently enacted reconciliation legislation. We applaud Congress and the Administration for preventing a major tax hike on American companies and families and bolstering U.S. competitiveness,” said Business Roundtable Chair Chuck Robbins, Chair and Chief Executive Officer of Cisco. “Another powerful step policymakers can take to build on this momentum and further strengthen the U.S. economy is to modernize our outdated permitting system, which is essential to unlocking infrastructure investments in everything from energy and transportation to AI.”

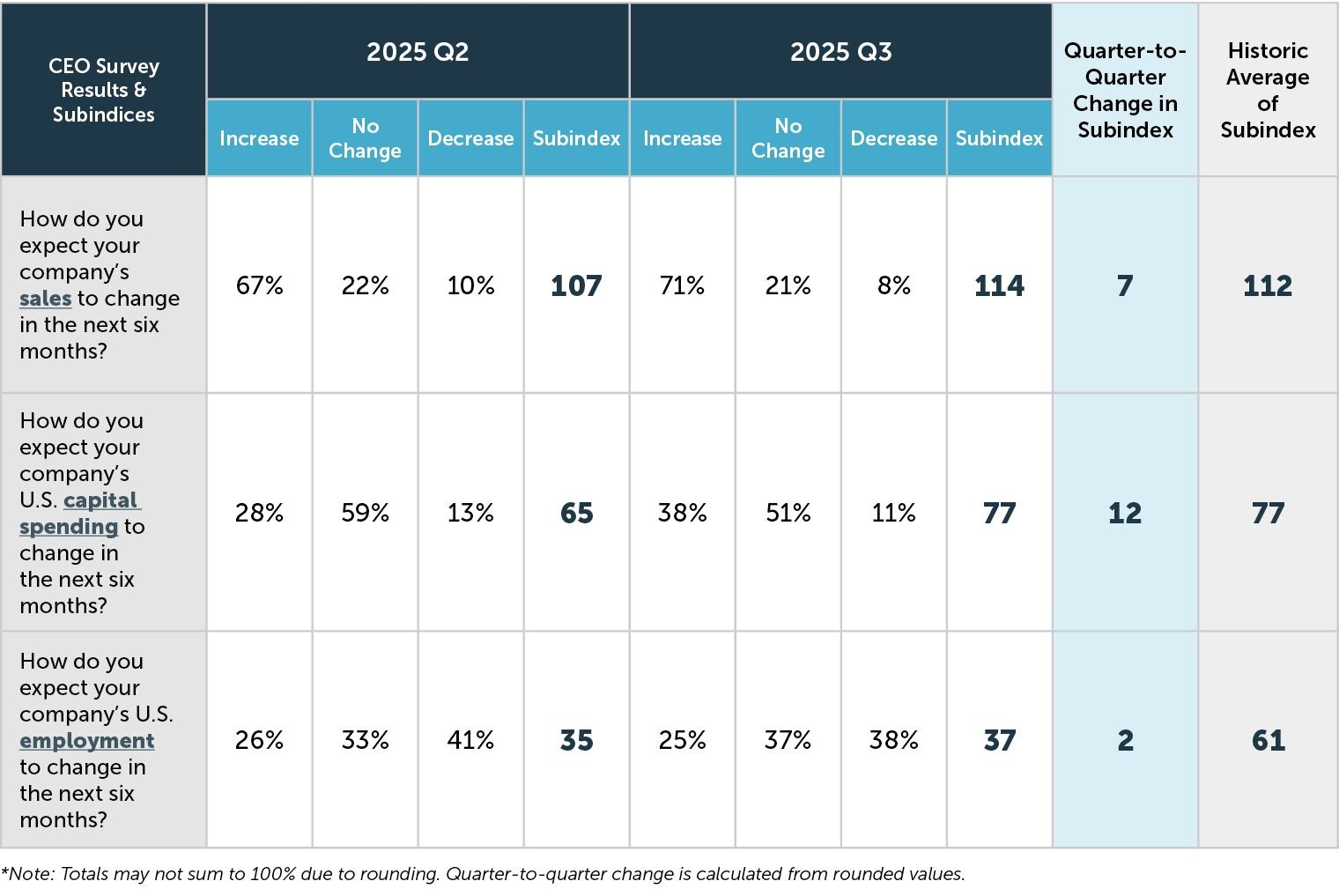

The Survey’s three subindices were as follows:

- Plans for hiring increased two points to a value of 37, marking the second quarter in a row in which the employment subindex fell below the level signaling contraction.

- Plans for capital investment increased 12 points to a value of 77.

- Expectations for sales increased seven points to a value of 114.

“Though we are pleased to see some recovery in CEO plans for capex, there’s fragmentation among the various sectors, with trade-exposed industries like manufacturing facing headwinds,” said Business Roundtable CEO Joshua Bolten. “The President has secured some significant concessions in trade negotiations, and we urge our trading partners and the Administration to continue working together to remove harmful tariffs and non-tariff barriers.”

This quarter’s survey was in the field from September 2 through September 12, 2025. In total, 157 CEOs completed the survey.

About the Business Roundtable CEO Economic Outlook Survey

The Business Roundtable CEO Economic Outlook Survey, conducted quarterly since the fourth quarter of 2002, provides a forward-looking view of the economy by Business Roundtable member CEOs. The survey is designed to provide a picture of the future direction of the U.S. economy by asking CEOs to report their company’s expectations for sales and plans for capital spending and hiring over the next six months. The data are used to create the Business Roundtable CEO Economic Outlook Index and sub-indices for sales, capex and hiring. These indices are diffusion indices that range between -50 and 150 — where readings at 50 or above indicate economic expansion, and readings below 50 indicate economic contraction. A diffusion index is defined as the percentage of respondents who report that a measure will increase, minus the percentage who report that the measure will decrease. The diffusion indices here are then normalized by adding 50 to the result.