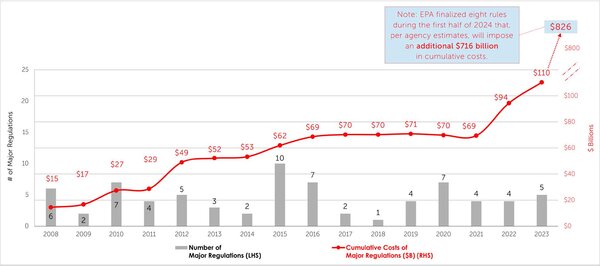

Source: OMB, Business Roundtable calculations. Excludes transfer rules and rules issued by independent regulatory agencies.

Agencies Should Prioritize Retrospective Review

With retrospective review, or “look-back analysis," agencies periodically assess rules to determine how well they are achieving their policy goals. Administrations of both parties have endorsed retrospective reviews,15 but they rarely occur in practice (and when they do, they are often ad hoc and under-resourced). President Trump’s recent executive order, directing agencies to review “regulations that impose significant costs upon private parties that are not outweighed by public benefits,” is a welcome indication that the Administration will prioritize retrospective review.16

In addition to reviewing prior regulations, Business Roundtable strongly supports requiring agencies to develop “prospective retrospective review plans” as part of the rulemaking process itself. These plans should identify clear regulatory objectives, specify metrics to track performance, and outline strategies for collecting and analyzing data over time. Embedding retrospective planning at the front end would make reviews more feasible and more likely to yield actionable insights about what works — and what doesn’t.

Regulatory Budgets Can Help Rein in Costs

Regulatory budgets impose constraints on the costs that regulators can impose when issuing new rules. During the first Trump Administration, OMB capped the total costs that agencies could impose in all their rules and, in some cases, required agencies to eliminate existing regulations before adding new ones.17 More recently, the Administration has taken more ambitious steps, including requiring agencies to incorporate expiration dates into energy-related rules18 and mandating a “10-for-1” replacement policy and setting a "significantly less than zero" cost threshold for new regulations.19 These recent efforts reflect a strong commitment to regulatory restraint and underscore the importance of building a durable framework to guide future reform efforts.

Although critics of regulatory budgets often point to the need to account for benefits as well as costs, a well-structured regulatory budget could accommodate offsets for rules that generate significant net benefits or achieve cost savings by revising existing rules.20 As such, regulatory budgeting — when paired with rigorous cost-benefit analysis and applied consistently and thoughtfully across agencies, including independent regulatory agencies — can be an important tool in addressing the cumulative regulatory burden. By establishing clear cost constraints on agency rulemaking, regulatory budgets create discipline, incentivize prioritization, and compel regulators to reexamine outdated or duplicative rules as a condition for issuing new ones. While the goal is to reduce unnecessary regulatory costs, a well-structured budgeting framework does not preclude important public protections; rather, it ensures that rules are subject to a meaningful threshold of justification. Just as thoughtful fiscal budgeting forces policymakers to consider tradeoffs when crafting spending bills, a well-considered regulatory budget can encourage agencies to focus their efforts on the rules that provide the greatest net benefits to society.

Improved Agency Coordination Would Reduce Overlap

Businesses are often subject to overlapping, inconsistent or even conflicting mandates from multiple agencies. These duplicative rules impose unnecessary costs and reduce the coherence of the regulatory system as a whole. To address this, agencies should be required to coordinate more closely during rule development — including through memoranda of understanding, joint rulemakings and designation of a lead agency for cross-cutting initiatives. In sectors such as energy, finance or data privacy, where multiple agencies have overlapping jurisdiction, interagency collaboration is essential to avoid imposing redundant reporting and compliance burdens on regulated entities. Similarly, regulators at the state and federal level — and where appropriate, with international counterparts — should collaborate to improve consistency and mutual recognition of standards, especially in areas that affect supply chains, emerging technologies or global competitiveness.

Public Engagement is Fundamental to Effective Regulation

Early public engagement is one of the most effective and underused tools available to federal agencies in the rulemaking process. Despite longstanding guidance to seek input from affected stakeholders throughout the rulemaking process, many continue to bypass this step. As a result, critical policy decisions — including the scope, design and cost of a regulation — are often made without meaningful outside input. By the time a Notice of Proposed Rulemaking (NPRM) is published, agencies are typically far along in their internal deliberations, making it more difficult to course-correct based on public feedback. This backward approach can lead to unnecessarily costly or unworkable rules that fail to reflect practical, lower-burden alternatives that stakeholders could have offered had they been consulted earlier.

Business Roundtable supports reforms that would make early engagement a standard feature of major rulemakings (including those intended to reduce the regulatory burden). Requiring agencies to issue a “Notice of Initiation” at the outset of a major regulatory or deregulatory process would create a formal opportunity for public comment before policy decisions are made. In addition, agencies should make more consistent use of Requests for Information (RFIs) and Advance Notices of Proposed Rulemaking (ANPRMs), which can surface policy alternatives that achieve regulatory objectives more cost-effectively. Greater use of these engagement mechanisms would not only improve rule quality but also foster a more transparent, accountable and responsive regulatory system. This is particularly important for deregulatory activities: given that agencies can no longer rely on “Chevron deference” and must demonstrate that their legal interpretations and factual support for new rules are as reasoned (or more reasoned) than those supporting the original rule, establishing a record of soliciting — and, where appropriate, incorporating — public input can help ensure a rule can withstand judicial scrutiny.

Conclusion: A Lasting Commitment to Smarter Regulation

Business Roundtable appreciates the opportunity to weigh in on the Trump Administration’s deregulatory efforts. The cumulative regulatory burden is the result of decades of incremental rulemaking layered without adequate coordination, review or removal. Addressing it in a manner that will stand the test of time is of critical importance — and can be achieved while still protecting public health, safety and consumer welfare.

In its first 100+ days, the Trump Administration has taken important steps to embed a results-oriented, cost-conscious regulatory framework, particularly with respect to bringing independent agencies into the fold, applying budget constraints, and carefully scrutinizing existing rules with an eye toward rescinding or replacing those that are unnecessary, unlawful, unduly burdensome or unsound. To ensure these gains are sustained over the long term, however, further action is needed to institutionalize a data-driven, cost-benefit framework across all rulemaking bodies and processes.

Regulatory planning and analysis, interagency coordination, and a deep commitment to public engagement are foundational principles of effective regulation and should guide the Administration’s regulatory reform efforts in the years ahead. Business Roundtable offers several specific recommendations across these three areas in an appendix to this letter (see below) and stands ready to work with OMB, federal agencies and Congress to advance these reforms.

Appendix: Business Roundtable Recommendations to Ease the Cumulative Regulatory Burden

Business Roundtable has identified policy recommendations that reflect the principles of our philosophy toward regulation. These recommendations can guide Congress and the federal government as they consider policies to modernize our regulatory system and ease the cumulative regulatory burden.

To improve regulatory planning and analysis, policymakers should:

- Codify key principles of rigorous, transparent cost-benefit analysis. By creating an enforceable legal requirement, Congress would ensure that rules address a compelling public need, produce benefits that justify the costs they impose and are achieved in a cost-effective manner. Congress can also improve transparency by requiring agencies to disclose all data, assumptions, methods and models used in their analyses.

- Require agencies to use proper discount rates or shadow prices to ensure full consideration of opportunity costs when developing new rules.

- Ensure agencies conduct sensitivity and uncertainty analyses. Information about uncertainties and how they may alter a rule’s impact can better inform policymakers and the public about how likely a rule will achieve its estimated benefits.

- Require agencies to provide additional justification of major rules that depend heavily on ancillary benefits. When indirect benefits are a primary driver of a proposed rule’s societal value, agencies should demonstrate why they are regulating in a manner that achieves these benefits through indirect means when a direct approach could be more cost-effective.

- Require independent regulatory agencies to conduct cost-benefit analyses. Closing the independent agency loophole would ensure that every impactful rule is subject to the same rigorous evaluation.

- Require agencies to develop retrospective review plans during the rulemaking process. Prospective planning can make look-back analysis more accurate, less costly and more likely to occur.

- Consider establishing agency-specific regulatory budgets. A carefully considered regulatory budgeting regime that also accounts for benefits can encourage agencies to more fully consider the cumulative costs of new rules.

To improve interagency coordination and reduce regulatory overlap, policymakers should:

- Enhance interagency coordination within the federal government. For example, federal agencies should establish memoranda of understanding and interagency working groups to promote coordination; conduct joint rulemakings for cross-cutting regulatory activities to improve consistency; and designate a lead agency to avoid duplicative rules.

- Facilitate coordination between regulatory agencies at federal, state and local levels. Convening federal, state and local regulators to discuss and harmonize rules would streamline compliance for business and reduce costs.

- Strengthen international regulatory cooperation. Communicating and coordinating with regulators outside the United States can help establish consistent regulatory practices and minimize areas of divergence that complicate compliance.

To enhance public engagement and improve rule quality, regulators should:

- Make greater use of Requests for Information (RFIs) and Advance Notices of Proposed Rulemaking (ANPRMs). These tools inform agency decision-making by creating opportunities for the public to provide input. Requiring agencies to use them would foster public engagement and equip regulators with valuable feedback as they develop regulatory alternatives.

- Require a “Notice of Initiation” for each major rule. RFIs and ANPRMs are often issued after agencies have already made key policy decisions. Requiring agencies to first issue a “Notice of Initiation” when beginning a major rulemaking process would allow stakeholders to provide earlier input, thereby helping agencies formulate and shape potential regulatory alternatives before getting too far down the road on a given approach.

- Target and engage relevant stakeholder groups early in the rulemaking process. The Small Business Regulatory Enforcement Fairness Act (SBREFA) creates special outreach requirements for rules from designated agencies that are likely to have a significant impact on small entities. OIRA should encourage all agencies to experiment with an expanded SBREFA-like process that encompasses a broader set of rules and stakeholders to help identify optimal regulatory approaches.

Footnotes:

- 90 Fed. Reg. 15481 (April 11, 2025).

- Calculated from OMB Reports to Congress on the Benefits and Costs of Federal Regulations and Agency Compliance with the Unfunded Mandates Reform Act, 2008–2023. Calculations based on the average of the low- and high-cost estimate in 2001 dollars for all major rules for which agencies estimated costs. Cost estimates were converted to 2024 dollars using the Consumer Price Index for All Urban Consumers. “Major” rules are as those that have over $100 million in annual economic effect; significant effects on costs or prices for consumers; or significant adverse effects on employment, competition, investment, productivity, innovation, or global competitiveness.

- NERA Economic Consulting. (2012). “Macroeconomic impacts of federal regulation of the manufacturing sector.”

- Coffey, B., McLaughlin, P., and Peretto, P. (2016) “The Cumulative Cost of Regulations.” Mercatus Working Paper, Mercatus Center at George Mason University, Arlington, VA, April 2016.

- Trebbi, F., and Zhang, MB. (2023). “The Cost of Regulatory Compliance in the United States.” NBER Working Paper No. w30691.

- National Association of Manufacturers (2016). “Holding US Back: Regulation of the U.S. Manufacturing Sector.” Report prepared by Pareto Policy Solutions, LLC.

- Id. See also Marcus, A. (1981). “Policy Uncertainty and Technological Innovation.” The Academy of Management Review. Vol. 6, No. 3: pp. 443-448.

- Based on agency cost estimates for each rule and converted to 2024 dollars using the Consumer Price Index for All Urban Consumers. The eight rules are (1) Greenhouse Gas Standards and Guidelines for Fossil Fuel-Fired Power Plants; (2) Updated Mercury and Air Toxic Standards (MATS); (3) Steam Electric Power Generating Effluent Guidelines Final Rule; (4) Legacy Coal Combustion Residuals Surface Impoundments and CCR Management Units; (5) Multi-Pollutant Emissions Standards for Model Years 2027 and Later Light-Duty and Medium Duty Vehicles; (6) Greenhouse Gas Emissions Standards for Heavy-Duty Vehicles -Phase 3; (7) Standards of Performance for New, Reconstructed, and Modified Sources and Emissions Guidelines for Existing Sources: Oil and Natural Gas Sector Climate Review and (8) National Ambient Air Quality Standards (NAAQS) for PM.

- Gorman, L. (2023). “Tracking the cost of complying with government regulation.”

- Marcus, A. A. (1981). “Policy uncertainty and technological innovation.” The Academy of Management Review, 6(3), 443–448.

- Business Roundtable. (2014). “Using cost-benefit analysis to craft smart regulation: A primer and key considerations for Congress and federal agencies.”

- Calculated from Office of Management and Budget reports to Congress on the benefits and costs of federal regulations and agency compliance with the Unfunded Mandates Reform Act, FYs 2008–2023.

- Ibid.

- Executive Order 14215: Ensuring Accountability for All Agencies. Issued February 18th, 2025.

- See, e.g. Executive Order No. 13563, Improving Regulation and Regulatory Review. Issued January 18th, 2011.

- Executive Order No. 14219, Ensuring Lawful Governance and Implementing the President’s “Department of Government Efficiency” Deregulatory Initiative. Issued February 19th, 2025.

- Executive Order No. 13771, Reducing Regulation and Controlling Regulatory Costs. Issued February 3rd, 2017.; Bosch, D. (2021). “The legacy of the regulatory budget.”

- Executive Order No. 14270, Zero-Based Regulatory Budgeting to Unleash American Energy. Issued April 9th, 2025.

- Executive Order No. 14192, Unleashing Prosperity Through Deregulation. Issued February 6th, 2025.

- Shapiro, S. (2019). “The limits of thinking of a regulatory budget like a fiscal budget.” The Brookings Institute.