CEO ECONOMIC OUTLOOK INDEX

Business Roundtable CEO Economic Outlook Index Improves But Remains Below Historic Average

Washington – Business Roundtable today released its Q4 2025 CEO Economic Outlook Survey, a composite index of CEO plans for capital spending and employment and expectations for sales over the next six months.

The overall Index posted a four-point increase from last quarter to 80, below its historic average of 83. The slight shift reflects a modest uptick in CEO expectations for sales, with plans for capital investment inching up but essentially remaining flat. Additionally, while hiring plans rose by four points, this marks the third consecutive quarter in which more CEOs have anticipated that their company’s employment will decrease than increase.

“Although the results signal that CEOs are approaching the first half of 2026 with some caution, they are starting to see opportunities for growth. With the Index near its average, it reflects the resilience of the U.S. economy — which has been bolstered by the pro-growth tax policies Congress and the White House delivered this year as well as by the regulatory simplification efforts of the Trump Administration,” said Business Roundtable Chair Chuck Robbins, Chair and Chief Executive Officer of Cisco. “Bipartisan permitting reform for energy, technology and other infrastructure is one of the most significant actions Congress can take to boost domestic investment and innovation. As we look to the new year, the Roundtable will put its full weight behind working with Congress and the Administration to get it done.”

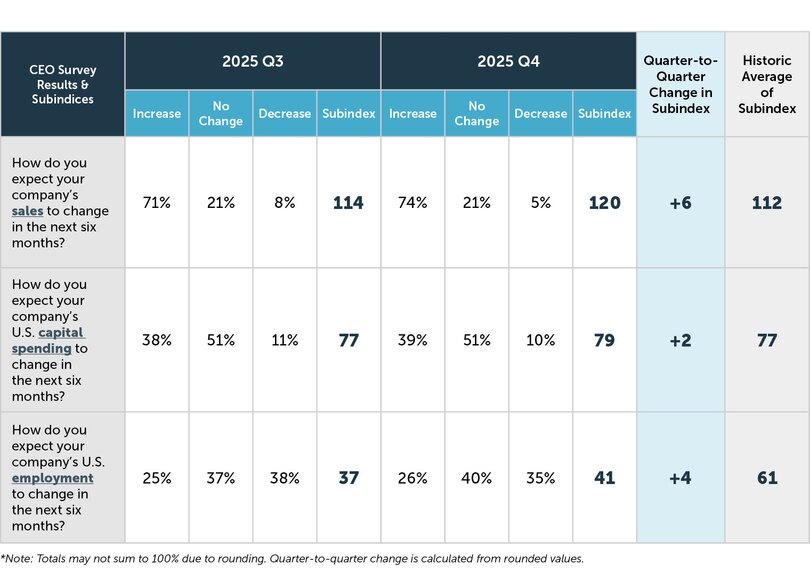

The Survey’s three subindices were as follows:

- Plans for hiring increased 4 points to a value of 41.

- Plans for capital investment increased 2 points to a value of 79.

- Expectations for sales increased 6 points to a value of 120.

Values above 50 signal growth, while values below 50 signal contraction.

“Notably this quarter, more CEOs plan to reduce employment than increase it for the third quarter in a row — the lowest three-quarter average since the Great Recession,” said Business Roundtable CEO Joshua Bolten. “CEOs’ softening hiring plans reflect an uncertain economic environment in which AI is driving sizeable capex growth and productivity gains while tariff volatility is increasing costs, particularly for tariff-exposed companies, including small businesses. We continue to urge our trading partners and the Administration to stabilize the system and bring tariffs down.”

In a question posed every fourth quarter since 2003, CEOs were asked to identify the greatest cost pressure facing their company. Thirty-one percent of CEOs identified labor costs for the ninth consecutive year, though the percentage declined 16 points compared to last year. Fifteen percent of respondents identified material costs, and another 15% indicated health care costs. Twelve percent of CEOs identified supply chain costs as their greatest cost pressure. Both material costs and supply chain costs are sensitive to tariffs.

This quarter’s survey was in the field from November 21 through December 5, 2025. In total, 164 CEOs completed the survey.

About the Business Roundtable CEO Economic Outlook Survey

The Business Roundtable CEO Economic Outlook Survey, conducted quarterly since the fourth quarter of 2002, provides a forward-looking view of the economy by Business Roundtable member CEOs. The survey is designed to provide a picture of the future direction of the U.S. economy by asking CEOs to report their company’s expectations for sales and plans for capital spending and hiring over the next six months. The data are used to create the Business Roundtable CEO Economic Outlook Index and sub-indices for sales, capex and hiring. These indices are diffusion indices that range between -50 and 150 — where readings at 50 or above indicate economic expansion, and readings below 50 indicate economic contraction. A diffusion index is defined as the percentage of respondents who report that a measure will increase, minus the percentage who report that the measure will decrease. The diffusion indices here are then normalized by adding 50 to the result.