CEO ECONOMIC OUTLOOK INDEX

Business Roundtable Q3 Economic Index Ticks Down as CEOs Temper Expectations

Washington – Business Roundtable today released its Q3 2024 CEO Economic Outlook Survey, a composite index of CEO plans for capital spending and employment and expectations for sales over the next six months.

The overall Index dipped 5 points from last quarter to 79 and is below its historic average of 83 for the first time in 2024. The decrease is the result of a modest reduction in CEO plans for employment and an easing in expectations for sales. Plans for capital investment have marginally increased from last quarter.

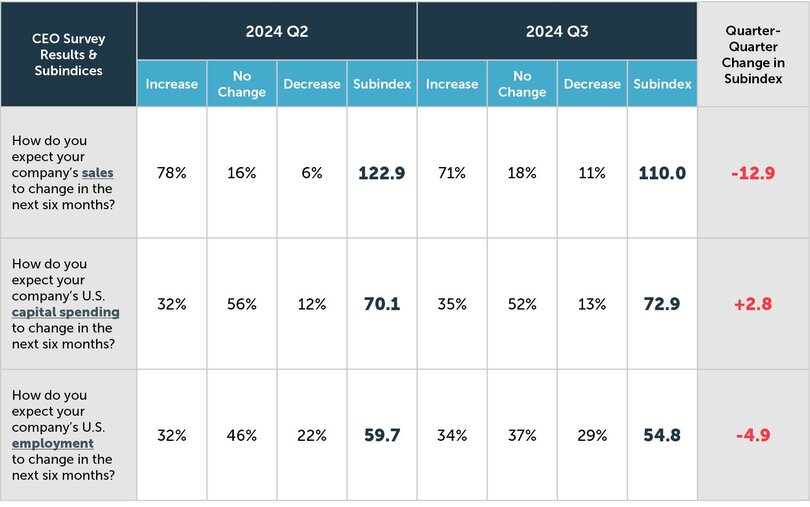

The Survey’s three subindices were as follows:

- Plans for hiring decreased 5 points to a value of 55.

- Plans for capital investment increased 3 points to a value of 73.

- Expectations for sales decreased 13 points to a value of 110.

“A majority of CEOs indicated they plan to maintain or increase capex in the near term — investing in equipment, technology and other tools that drive productivity and growth,” said Business Roundtable Chair Chuck Robbins, Chair and Chief Executive Officer of Cisco. “Lawmakers can help ensure the U.S. remains a great place for business investment by maintaining a globally competitive business tax system.”

“This is the second consecutive quarter in which CEOs have reported they are moderating their hiring plans — though with fewer than 30% indicating they plan to decrease hiring, not far below the historic average,” said Business Roundtable CEO Joshua Bolten. “Overall, the Business Roundtable survey results seem to be consistent with the Fed’s perspective on a softening economy.”

In their fourth estimate of 2024 U.S. GDP growth, CEOs projected 2.3% growth for the year, remaining the same as in the second quarter.

This quarter’s survey was in the field from August 28 through September 12, 2024. In total, 145 CEOs completed the survey.

About the Business Roundtable CEO Economic Outlook Survey

The Business Roundtable CEO Economic Outlook Survey, conducted quarterly since the fourth quarter of 2002, provides a forward-looking view of the economy by Business Roundtable member CEOs. The survey is designed to provide a picture of the future direction of the U.S. economy by asking CEOs to report their company’s expectations for sales and plans for capital spending and hiring over the next six months. The data are used to create the Business Roundtable CEO Economic Outlook Index and sub-indices for sales, capex and hiring. These indices are diffusion indices that range between -50 and 150 — where readings at 50 or above indicate economic expansion, and readings below 50 indicate economic contraction. A diffusion index is defined as the percentage of respondents who report that a measure will increase, minus the percentage who report that the measure will decrease. The diffusion indices here are then normalized by adding 50 to the result.